The white paper on status of agriculture in Andhra Pradesh

http://www.ap.gov.in/Other%20Docs/White%20paper%20on%20agri.%20and%20allied%20depts.pdf

The white paper on status of agriculture in Andhra Pradesh

Tea companies commit to Non-Pesticide Management in tea; Unilever and Girnar lead the way

After 50 hours volunteers climb down the billboards

August 13th, 2014, Mumbai: In an encouraging turn of events, two of the leading tea companies have come forward in support of Non-Pesticide Management (NPM) in tea. Earlier this week, Greenpeace India released its report “Trouble Brewing”1 highlighting pesticide residue in tea samples. Since then, companies have been coming forward to engage with us. In response, Unilever2 and now Girnar Tea3 have both committed to support the NPM approach, which could lead to phasing out pesticides in tea cultivation. Pilot studies will be the first concrete step in this direction.

“It is very encouraging that the tea companies are taking steps to provide their consumers pesticide-free tea. Unilever and now Girnar Tea have taken the first step in this direction. Greenpeace will continue to urge the tea industry to move towards a holistic, ecosystem-based approach that will gradually phase out pesticides and clean our chai,” said Neha Saigal, Senior Campaigner, Greenpeace India.

To highlight the urgency of the issue, volunteers had climbed up seven billboards at the Bandra Reclamation Road urging the tea companies to “Clean Chai Now”. After spending 50 hours on these billboards, the volunteers today climbed down acknowledging the progress shown by tea companies.

“We are happy that our efforts are paying off and companies are coming forward to engage with us in a positive way. We look forward to a day when all our tea is free from pesticides,” said Bindu Vaz, one of the volunteers.

Notes to the editor:

1) http://www.greenpeace.org/india/en/Press/Greenpeace-calls-on-the-industry-to-save-Indian-tea-from-pesticides/

2)http://www.unilever.nl/nieuwsenmedia/persberichten/2014/UnileverstartonderzoekinIndianaarmogelijkheidtheetetelenzonderpesticiden.aspx

3) https://twitter.com/TeasAtGirnar

For more information: http://grnpc.org/cleanchai

Follow us on twitter: @GreenpeaceIndia

Contacts:

Shashwat Raj: Senior Media Officer, Greenpeace India, +91 9971110144, [email protected]

Neha Saigal: Senior Campaigner, Greenpeace India, +917760968772, [email protected]

Telangana Government GO on Crop Loan Waiver

140813 Loan Waiver GO Telangana

The eligible amount for debt waiver would be limited to the amount of loan (together with applicable interest), which is disbursed and outstanding as of 31st of March, 2014 or Rs.1,00,000 per farmer family whichever is lower. The farmer family is defined as head of the family, spouse and dependent children.

The following loans/accounts shall not be eligible under the Crop Loan Waiver Scheme.

a) Advances against pledge or hypothecation of agriculture produce other than standing crop

b) Tied loans

c) Closed crop loan accounts

Short term production loan means a loan given in connection with the raising of crops which is to be repaid within 18 months. It will include working capital loan, for traditional and non-traditional plantation and horticulture.

Implementation Guidelines of the Scheme

a) Preparation of list of farmers with outstanding crop loan dues and arriving at the amount of claim

i) Each lending institution – bank branch – which has disbursed short term crop loans to farmers shall prepare village-wise list of farmers with outstanding crop loan dues as on March 31, 2014 in the prescribed format (Annexure-A).

ii) Each lending institution, shall also prepare a village-wise list of farmers who have outstanding dues as on March 31, 2014 in respect of crop loans taken against gold in the prescribed format (Annexure-B).

iii) The list of farmers in Annexure-A and Annexure-B should be compared by the Bank Branch Manager and a final list of farmers who have outstanding crop loan and limited to a maximum extent of Rs.1.00 lakh should be prepared by the Bank Branch Manager in the format designed in Annexure-C. One copy of Annexure-A, B, C should be sent by the Bank Branch Manager each to LDM and District Collector.

iv) Some of the farmers might have taken crop loan/agriculture gold loan for crops from more than one bank branch of same bank or another bank. Hence, for eliminating the duplication/multiple financing and restricting the benefit of loan waiver of Rs.1.00 lakh per farmer family, a Bankers meeting at Mandal level will be convened by the JMLBC (Joint Mandal Level Bankers Committee) Convener. At the JMLBC meeting all the Banks will come with the lists of eligible farmers prepared in the proforma as in Annexure-A, B & C prescribed by the Government, and compare the list of farmers in Annexure- C with Annexure- C list of other bank branches in the mandal belonging to all the other banks (commercial, rural, cooperative). The mandal Tahsildar will also check all names in Annexure- C of all banks in the mandal and will verify if there are any fake pattadar pass books and also if all loanees have farm land. After this verification any false claims will be deleted. Then the farmer family who have availed loans from more than one bank branch will be identified by the JLMBC members. Their details will be recorded by the JLMBC in Annexure- D. The Co-op. Dept. auditors under the supervision of District Co-op. Audit Officer shall cross verify the A, B, C with D list pertaining to PACs and DCCBs. The DCAO shall allot the auditors to Mandals under his jurisdiction under intimation to the District Collector. A senior officer not below the rank of Deputy Collector and nominated by the District Collector will be the observer for this meeting. The Annexure-D thus prepared in JLMBC will be shared by all bank branches at the mandal level.

v) After comparing and deleting farmer family who have taken loan in more than one bank branch (Comparing Annexure C and D) each bank will prepare Annexure-E. It is to be noted that if a farmer family has multiple accounts but overall outstanding for crop loan is less than Rs.1.00 lakh, then their name will not be deleted. In case outstanding crop loan is more than Rs.1.00 lakh, then the name will be retained in the bank where the farmer family first availed the crop loan or where the outstanding amount is higher, the latter being the first priority. Annexure-E will be the final list of farmers bank branch wise who will be eligible for loan waiver.

vi) Annexure-E will be exhibited village wise and social audit conducted by a team consisting of MPDO, Tahsildar, AR (SDLCO)/Sl.& Branch Manager or his representative. After conduct of social audit and finalization of all objections received the final list of farmers bank branch wise will be prepared in Annexure-E (final). After the social audit and after taking into account the objections of villages, if any, a final village-wise list of eligible farmers along with the amount eligible for waiver shall be prepared Annexure ‘E’ and displayed at all bank branches after due authentication. The final list shall be sent to the LDM and the District Collector in Annexure-E.

vii) A District Level Bankers’ meeting will be convened (DCC) by the LDM and district details of loan waiver bank wise, farmer wise will be recorded and sent to SLBC in Annexure-E. SLBC will intimate Bank wise, Branch wise farmers eligible amounts to be released to the Government in Annexure-E.

b) Claim reimbursement by the Government to the lending institutions

i) The final list shall be consolidated village-wise and district- wise by convening a meeting of the District Level Bankers’ Committee. After consolidating all such lists from the districts, the banks would need to raise a claim with the Government, which would be reimbursed to the banks.

ii) After adjustment of loan waiver amount by the State Government, each branch shall certify the amount of outstanding crop loans waived after duly crediting the amounts in the crop loan accounts of farmers. Before crediting the amount, an undertaking should be taken from the farmer in that he shall repay the amount of waiver if it is found subsequently that he/she has fraudulently obtained the crop loan or is found not eligible for crop loan waiver under the Scheme. A certificate of loan waiver in Annexure ‘F’ shall also be issued by the bank branch to each farmer, whose outstanding loan has been waived. The amount of loan waiver shall be consolidated bank-wise for the entire State.

iii) A meeting of the JMLBC shall be convened within one month of the completion of procedures laid down in i) and ii) above.

Audit

After the completion of procedures in i) and ii) above, the auditors of the Cooperation Department shall take up the audit of Primary Agricultural Cooperative Societies to ensure accuracy of the waiver amounts and shall submit the audit report to the Chief Auditor. The books of accounts of every lending institution that has granted crop loan waiver shall be subject to an audit in accordance with the usual procedure prescribed by RBI / NABARD. The audit may be conducted by concurrent auditors, statutory auditors or special auditors.

Obligations of lending institutions

Every lending institution shall be responsible for the correctness and integrity of the list of farmers eligible under the scheme and the particulars of crop loan waiver in respect of each farmer. Every document maintained, every list prepared and ever certificate issued by a lending institution for the purpose of the scheme shall bear the signature of an authorised officer of the lending institution.

Monitoring and Grievance Redressal

There will also be a suitable monitoring and grievance redressal mechanism established at Mandal, District and State levels and every representation has to be disposed off within 30 days. Detailed orders in this regard would be issued separately.

Fresh Lending and agriculture campaign

Since the eligibility for loan waiver is decided based on the outstanding crop loan as on March 31, 2014, along with the interest on it computed up to the date of implementation to be notified by the State Government, and the liability will be taken over by the State Government. All the bankers should commence fresh lending of crop loans immediately. For clarity, it is reiterated that the eligible loan amount as computed by following the prescribed procedure shall be reimbursed irrespective of its renewal subsequent to 31-03-2014.

(BY ORDER AND IN THE NAME OF THE GOVERNOR OF TELANGANA)

POONAM MALAKONDAIAH,

APC & PRINCIPAL SECRETARY TO GOVERNMENT.

To

The Commissioner & Director of Agriculture,

Government of Telangana, Hyderabad.

Copy to:

The Principal Secretary to Chief Minister.

The P.S. to Hon’ble Minister (Agri & A.H.)

The P.S. to Chief Secretary.

The Finance (EAC) Department.

The Accountant General, Telangana, Hyderabad.

The Pay and Accounts Officer, Telangana, Hyderabad.

SF/SCs.

Notes on Telangana Agriculture 2.0

Notes and Presentation on Telangana Agriculture for the workshop on ‘Telangana Agriculture-Problems and Way forward’ on 11th August at Osmania Univertisty Centre for International Programs (OUCIP) from 9.30 am to 5.30 pm

Addressing Agriculture Issues in Telangana

Venue : OUCIP (Former ASRC) Osmania University

Date: 11th August 2014.

Time: 10.30am to 5 pm

Sessions would be facilitated by Prof. Kodandram

This meeting is jointly organized by Rythu Swarajya Vedika and Telangana Vidyavanthula Vedika in continuation to the Round Table meeting held on 25th March in Osmania University. This meeting is being held in the context of severe crisis in all the Telangana districts the meeting would be in three sessions:

Session I – 09.30 am – 1pm

Discussion on Issues and coming out with concrete proposals for addressing them

- Need to bring a change in Cropping Patterns towards diverse dryland crops

- Support in the form of subsidy, credit, insurance, seeds

- Pricing – support prices for all crops

- Building livestock wealth to rejuvenate agriculture and allied livelihoods

- Extension services and cooperatives

- Regulations – Seed Bill(towards seed sovereignty), Land

Session II – 2 -4 pm

Prioritization of Issues at district level and state level to be taken up for long term Action

Session III – 4 – 5 pm

Action Plan for advocacy, campaign and studies to be taken up jointly at various levels

[slideshare id=37838118&doc=140810telanganaagriculture2-140809234815-phpapp01&type=d]

[slideshare id=37838142&doc=140614-140809235050-phpapp02]

How Many Farmers Does India Really Have ?

It’s a bit of a mystery question. Reason is most data tells you that more than half of India’s population lives on or off agriculture. But does it really ?

The World Trade Organization General Council which met on July 24-25 failed to arrive at a consensus on the Doha Round talks thanks to India’s position on agriculture subsidies. Needless to add, this has once again put the spotlight on India’s large farming populace. And thus some curiosity on how many farmers there really are.

Now Census 2011 says there are 118.9 million cultivators across the country or 24.6% of the total workforce of over 481 million. The table below shows the number and percentage of cultivators, according to Census, since 1951 to 2011.

It can be seen from the table above that although the number of cultivators has been fluctuating, the percentage of cultivators has been coming down steadily. It has declined from nearly 50% in 1951 to 24% in 2011, which means the number of farmers has come down by half.

Let us now look at another set of numbers:

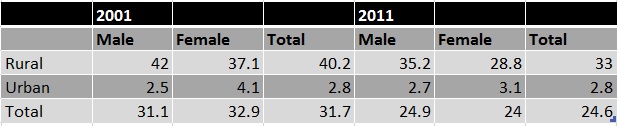

Number of Rural-Urban Cultivators, 2001 & 2011

Source Census (Figures in%)

From the table above, it is clear that total cultivators in rural areas have declined from 40% in 2001 to 33% in 2011. Gender-wise, females have moved away more sharply than their male counterparts from being cultivators. Their percentage has fallen from 37% in 2001 to 29% in 2011.

Lets get two views in. Journalist P.Sainath says there are 95.8 million cultivators for whom farming is their main occupation, which is less than 8% of the population. Devendra Sharma, agricultural researcher and policy commentator told us that “unlike the US, in India when the family owns a piece of land everyone works on the farm. So if we make a rough calculation of say 90 million households engaged in agriculture and multiply it with 5 (the average Indian family size) the number you get pretty much is equivalent to 53%”

Let us now try and look at the data of agriculture labourers, according to Census 2011. Very often, agricultural labourers are added with cultivators to calculate the number of farmers. This is not the case with the Census, which defines agriculture labour: ‘A person who works on another person’s land for wages in money or kind or share is regarded as an agricultural labourer. She or he has no risk in the cultivation, but merely works on another person’s land for wages. An agricultural labourer has no right of lease or contract on land on which she/he works.”

The following table shows the number of agricultural labourers from 1951 to 2011.

We can see from the table above that the number of people working as agricultural labourers has been increasing since 1951. And the percentage of agricultural labourers has increased from 19% in 1951 to 30% in 2011.

This shows that quite a few people have actually moved from being cultivators to being agricultural labourers. During the decade 2001-11, the Census results show a fall of about 9 million in cultivators and an increase of about 38 million in agricultural labourers!

So, if we add the number of cultivators and agricultural labourers, it would be around 263 million or 22% of the population (1.2 billion). Then where does the common perception of 53% of population being involved in agriculture come from? It needs to be remembered that over 600 million Indians dependent on agriculture are not farmers. They are deployed in an array of related activities including fisheries. And this confusion is widespread and innocent!!!

Update 11th August,2014:

P.Sainath responded to us. According to him, the census data on agricultural workers is further broken down according to main and marginal workers. The following table shows precisely this information on workers whose main and marginal occupation is cultivators.

| Category | Person | Male | Female | |

| Main work | ||||

| Rural | 92.7 |

|

22.2 | |

| Urban | 3.1 |

|

0.5 | |

| Total | 95.8 | 73.0 | 22.8 | |

| Marginal work | ||||

| Rural | 22.2 | 9.3 | 12.8 | |

| Urban | 0.6 | 0.3 | 0.3 | |

| Total | 22.8 | 9.6 | 13.1 | |

Source: Census 2011 (figs in million)

(Image Credit: Flickr)